When you’re building a Go-To-Market (GTM) strategy, the only way to properly identify your Ideal Customer Profile (ICP) and increase revenue opportunities is to nail down the total market demand for your product or service. What you need is a data-driven way to confidently make business decisions – choices that may have an impact for years to come.

An important first step in GTM planning is defining your Total Addressable Market. In this quick guide, we’ll walk you through what it is, how to calculate it, and how to master it the modern way through technology intelligence.

What Is Total Addressable Market?

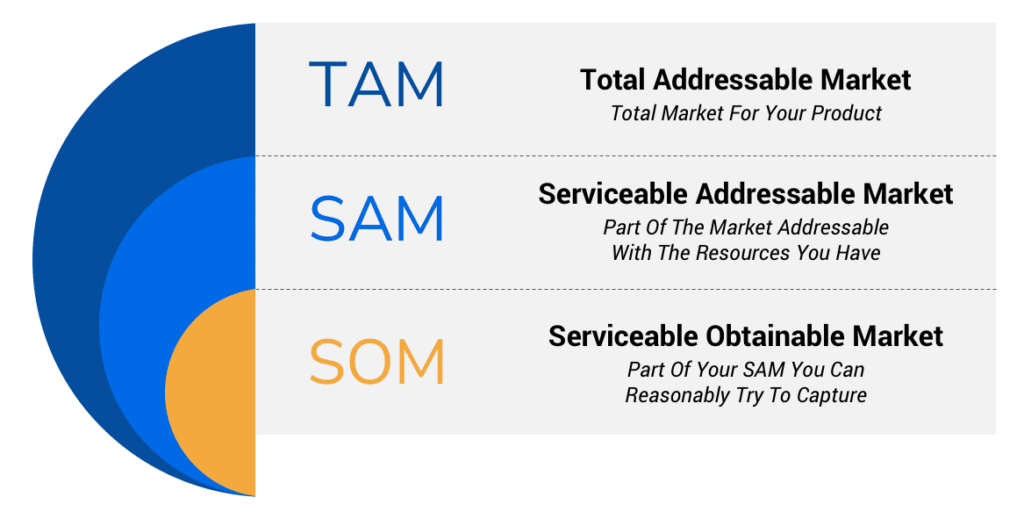

Total Addressable Market (TAM), sometimes called Total Available Market, is the total number of companies that could buy your product or service – the “size of the prize” so to speak.

You could further break down TAM by companies that actually have the ability to buy from you (a selective TAM) or you could prioritize, prospect, or assess propensity and potential inside that subset. Eventually, this narrowing down would bring you to your Serviceable Available Market (SAM) or Serviceable Obtainable Market (SOM), but we’ll just focus on TAM for now.

As a seller or marketing leader, understanding your TAM is a critical activity, as it is indicative of the total scope of your market opportunity. Without it, you won’t have an accurate picture of who you’re targeting and how much revenue they could generate for your business.

How To Calculate Your TAM

Traditionally, there are three common approaches to calculating your TAM:

- Top-down

- Bottom-up

- Value theory

There are also more modern ways of calculating TAM that rely on advanced data platforms. More on that below.

Top-Down TAM

Calculating TAM from the top-down involves looking to industry data and research studies from external sources like Gartner or Forrester. You can then figure out which parts of an industry are in alignment with what you offer and estimate the opportunity size.

This approach is typically the least accurate, as it assumes 3rd party data sources will be up to date and accurate about unique market characteristics (unlikely).

While sources like Gartner and Forrester are highly respected and reliable for macro-level insight, they should not be the sole basis of your TAM calculations.

Bottom-Up TAM

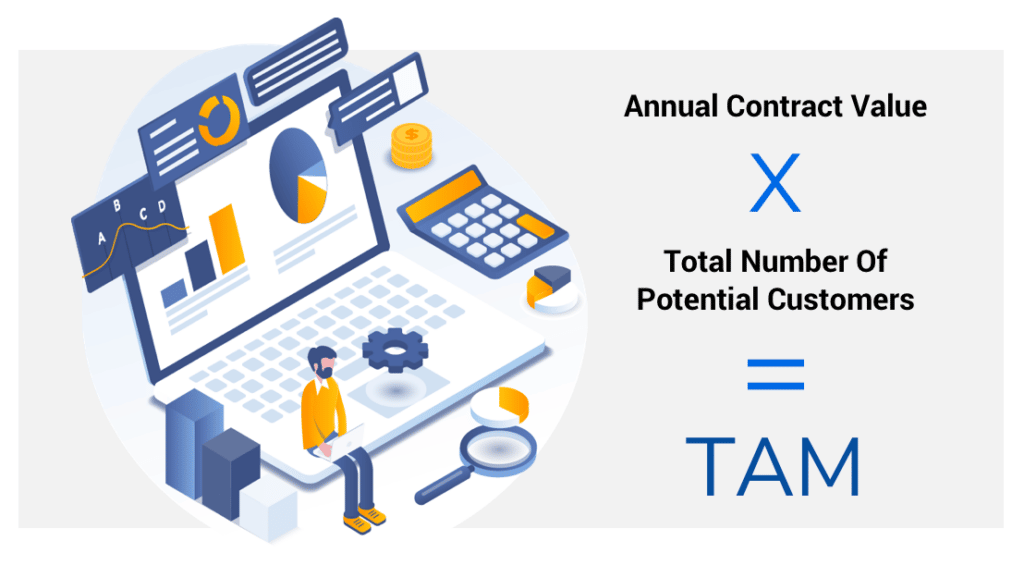

The bottom-up calculation approach for TAM is based on your own sales and pricing data. The simplest version would be to multiply your annual contract value (average sales price times number of current customers) by your total number of potential customers.

The top-down approach looks at current industry size, while bottom-up is based on product-market fit. It uses actual sales among your current customer base as proof that there is a market for the product, then extrapolates those sales to show the revenue opportunity in the future.

As part of this approach, you might also consider other factors like:

- Different market segments

- Addressability of each segment

- Competitors’ sales

While bottom-up calculations are certainly more thoughtful and show a deeper understanding of the market, it’s not a perfect approach. Challenges include limited sample size, basing calculations on faulty pricing, limiting market potential by only looking at current customers, and more.

To mitigate these concerns, be sure to analyze data on your customers’ product adoption, usage, and spending so you can spot other vertical and prospect opportunities outside your current customer base (Hint: HG Insights can help you build a TAM with actionable data on your prospects).

Value Theory TAM

This approach is based on the estimated value a customer receives from your product and how much they’ll be willing to pay for it in the future. This approach may be more prevalent among founders who are aiming for market disruption or even new market creation. However, this type of analysis is not driven by data and is largely based on subjective assumptions regarding how customers may behave in the future.

Mastering TAM The Modern Way with HG Insights

Using technology intelligence lets you build the most accurate TAM available. Understanding the specific products, attributes, or features a business may be using ensures that when creating your TAM, you’re able to select, refine, and identify the best prospects for your business.

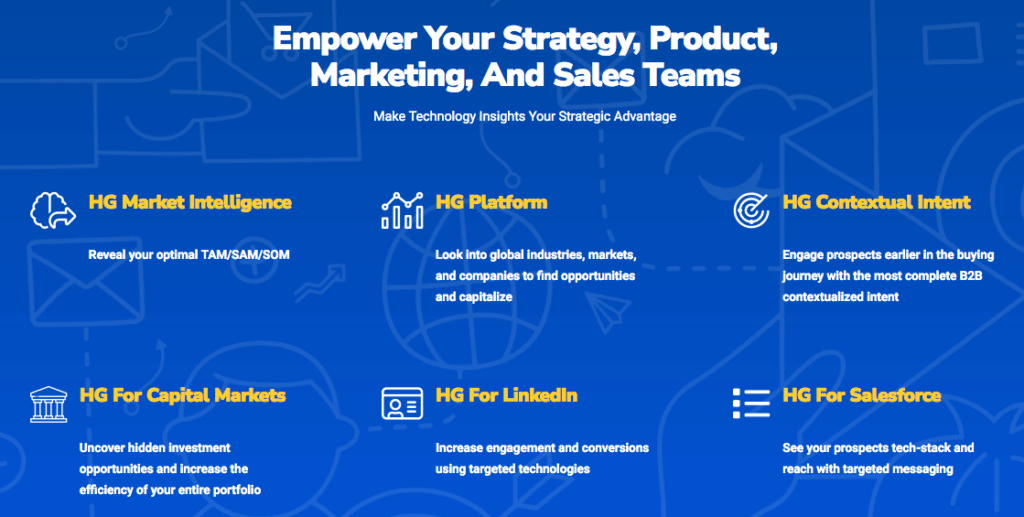

HG Insights provides business decision-makers with actionable insights they can use to identify and prioritize their best prospects and opportunities. Our suite of solutions allows you to integrate technology intelligence at any stage of your customer journey:

Contact us today to learn how HG Insights can help you understand your TAM and power data-driven decision making from forecasting through execution.