Thirteen out of seventeen Financial Planning & Analysis (FP&A) vendors have changed their positions since my last assessment conducted in May 2022.

Of the four that didn’t change their position, three probably should have because their positions are ineffective for reasons explained later in this assessment.

Only Kepion has done it right by sticking with the same unique position – “Planning your way” – for more than three years.

What is a position?

A position is the mental space in your target buyer’s mind that you can occupy with a claim that has meaning to the recipient. It’s in this mental space where your solution to a pressing target buyer problem meet and form a meaningful relationship.

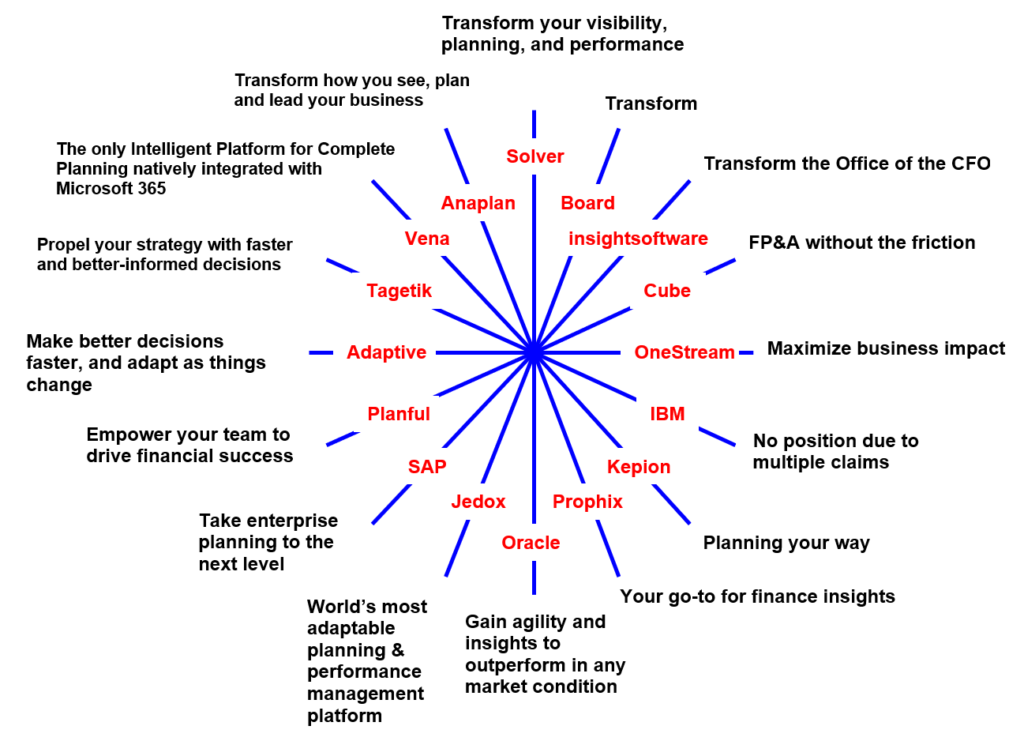

With this definition in mind, the competitive map below makes it easy to see how the FP&A vendors are positioned relative to each other.

My findings are based on an analysis of vendors’ website home pages and several other pages such as product overview, why us and about us. Most vendors express their positions on their home page. Here is the competitive map created in mid-July 2023:

As you can see, “transform” is the most popular position in the FP&A market. That’s not surprising because various forms of “transform” such as “transformation” and “digital transformation” are the most common buzzwords in B2B software marketing history.

Anaplan and Board changed positions in a vacuum

But you have to wonder what Anaplan and Board were thinking when they changed to “transform” positions. Solver, another vendor claiming the “transform” position, was not included in the May 2022 assessment.

All three vendors obviously pay no attention to how other competitors are positioned. Or they wouldn’t have come up with a position similar to insightsoftware’s “Transform the office of the CFO.”

However, insightsoftware should have moved away from its “transform” position because it’s not a believable claim.

“Transform” means changing from one form to a radically different form. Helping those in the CFO’s office do tasks better, faster and even cheaper isn’t a transformation. It’s simply a better way of doing everything in the office of the CFO.

It takes at least a year to establish a position if it is believable, unique and important to the buyer. Plus it needs to be executed consistently and repeated often. But once you own a position, why change it when it is just starting to pay dividends?

Expect a multi-year relationship with your position

I think you should use the same position for at least 18 months and ideally much longer. Even longer than Kepion has stuck with its position (three years and counting). Salesforce executed the same “success” position for more than 10 years.

OneStream was on its way to claiming “conquer complexity” when it changed to “maximize business impact.” Both are strong, unique positions but OneStream is starting all over in its effort to claim “maximize business impact.”

Oracle and Tagetik also didn’t change their positions but probably won’t benefit from sticking with them.

Oracle’s position: “Gain agility and insights to outperform in any market condition” uses two overused words – agility and insights. Plus Prophix also claims “insights” in its position.

Tagetik’s position: “Propel your strategy with faster and better-informed decisions” is a good way to express a “decision” position, but to be different, it best to come up with something that stands out. Adaptive has a similar position.

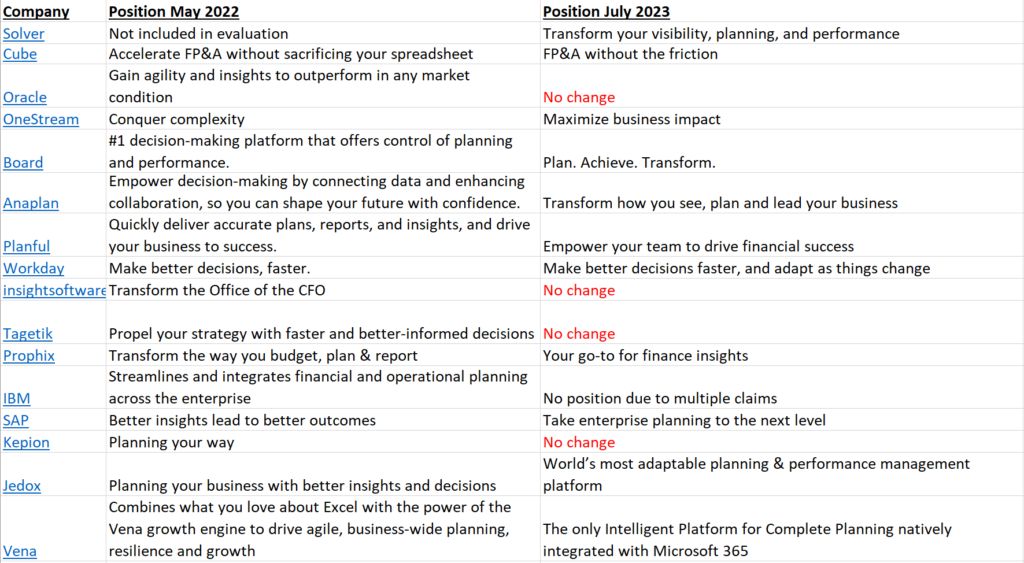

Here is a table with vendors’ positions in May 2022 and their current positions as of mid-July:

Here’s how I rate some of those vendors who changed their positions:

Better than 2022: SAP because it moved away from “insights;” Jedox because it moved away from “better insights and decisions.”

Good to good: Cube, OneStream.

No improvement: Planful, Workday, Vena, Prophix though “insights” better than “transform.”

Worse than 2022: Board, Anaplan, IBM

Why is it so common for vendors to change positions, not just in the FP&A market but all major B2B software and technology markets?

One reason – not a good one – companies change their positions is because their marketers and product marketers get tired of the same old position. But that’s the hint to stick with it. You’ll get tired of your position sometimes even before some prospects notice it.