What is price elasticity?

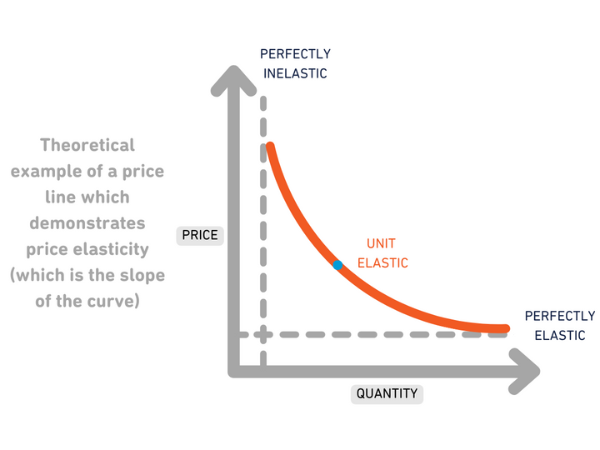

Basic demand and supply theory tells us that demand will go down when prices go up. But by how much? If you increase prices by 10%, will demand decrease by 10%?

The relationship (correlation) between the price change and the following change in volume sales is what can be expressed in a number: price elasticity. For example, prices increase by 5%, but after that demand drops by 10%. This would imply a ratio of -10%/5% = -2; demand drops twice as much as the price increases in relative terms. Because there is an inverse relationship between prices and demand (demand goes down if prices go up), the number is typically negative.

Keep in mind that the price elasticity is not 1 fixed number for a product; at each price point the number may be different. For example, a TV may be very price elastic at €500 (a typical price for a normal TV) but very in-elastic at €10.000; at €10.000, there might be nobody interested in the TV and lowering by 1% or 2% will likely not change that.

Pitfalls of price elasticity

Many brands look at price elasticity in isolation and estimate volume changes based on that one number, but this is not the correct approach.

- First, think on what level you want to analyse price elasticity effects.

For example, if you are using the price elasticity to estimate demand changes for just one product, it requires a very different analysis than an overall price increase. - In the current market, brands follow prices very carefully and can sometimes follow a price change you initiated or start one themselves that you might need to follow. Always check your competitor movement and think about how they might react to your moves.

- Be mindful of the price-gap with competing products to make sure the price distance is just right for optimal rotation.

- You might want to exempt a few products/brands/countries from your overall price change, where you might run more risk in losing market share (due to higher price elasticities than your competitor). This is also relevant when prices might eventually go down again to prevent a price war, which may lead into a downward price spiral.

How to use price elasticity to steer pricing decisions

- To estimate the demand change from a price change, you first plot historic data and then use the price elasticity that you find to estimate the volume change.

- Find the price elasticity and use it to estimate the volume effect. Ideally you would like to split between promo and non-promo price (and its corresponding sales).

- For individual products, check the price-gap with competition to make sure price distances are optimal.

- If multiple prices are changed at one go, consider making a price elasticity matrix to estimate the effects. This is a simplification, but will serve as a general guideline.

- You should always consider exempting certain products or markets if the price effect is too large compared to your overall portfolio.

- It is important to keep updating the data points with new data, as the market is constantly shifting. With this in mind, be very mindful of the timeline you choose as a base for the analysis; if prices have shifted drastically in the last year, you might want to use data only from the last year to estimate your price curve.

This first blog in our new Master Class series was about price elasticity. Today we discussed the general framework and important things to avoid or keep in mind. Look out for our next blog in a few weeks where we will continue exploring price elasticity analysis. In the future we will cover many more topics such as assortment & distribution analyses and more! Be sure to look out for our next Master Class series blog coming soon!

If you would like to talk to one of our expert consultants on the topic of price elasticities and how to use them to increase your organization’s revenue, please contact us today.

-1.png)