Salestech is hot.

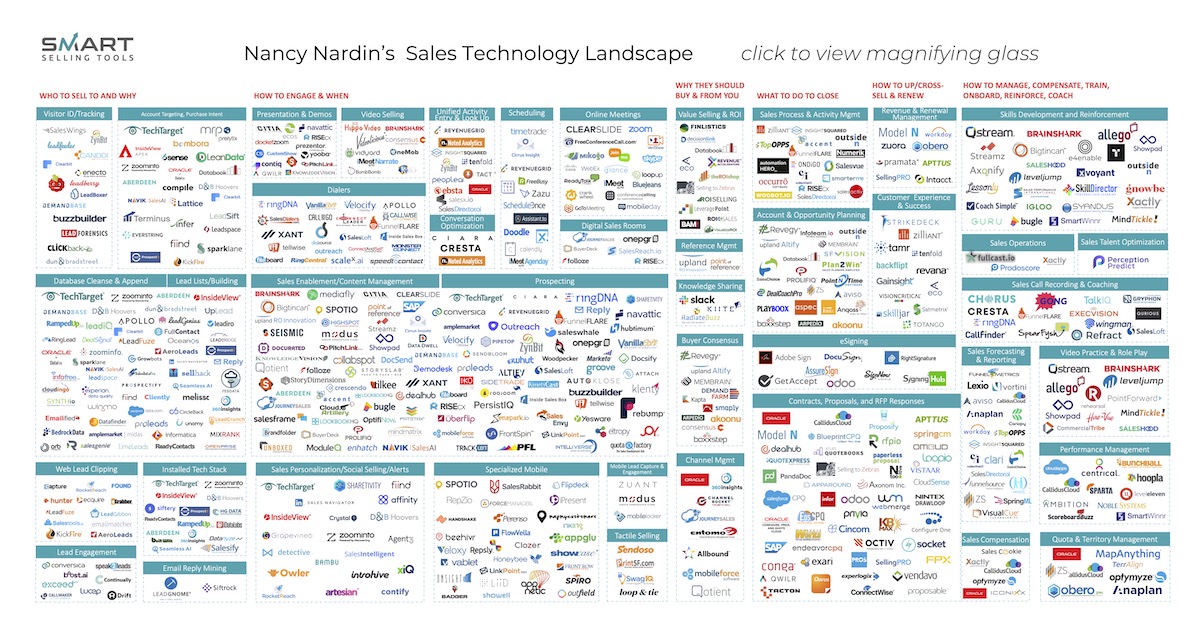

Nancy Nardin of Smart Selling Tools has been tracking sales technologies the way I’ve been tracking the martech landscape. Her latest map of salestech reveals hundreds and hundreds of vendors in the space, organized into a couple of dozen categories.

And as with my martech landscape, it’s not even complete. I personally know dozens of great salestech companies that aren’t included. (Nancy: I empathize with all the emails you surely must receive on that front.) And more are being launched every month.

In HubSpot’s App Marketplace — disclosure: where I work — we’ve seen a flood of innovative new sales apps and integrations published just in the past 12 months.

The dynamics behind this explosion of SaaS-based sales tools are the same as with martech: consolidating platforms and expanding app ecosystems around them. Examples of platform-first specialist salestech apps include Troops, which connects messaging platforms such as Slack and Teams with CRM platforms such as HubSpot and Salesforce, and Docket, which deeply integrates between Zoom, CRMs, Slack, calendars, and digital storage to make meetings super streamlined.

Multiple leading salestech companies are achieving billion-dollar valuations. Recently crowned “unicorns” in the space include Outreach, which hit a $1.33 billion valuation last summer, and SalesLoft, which achieved a $1.1 billion valuation just last week.

Naturally, where there’s this much supply, there’s a ton of demand.

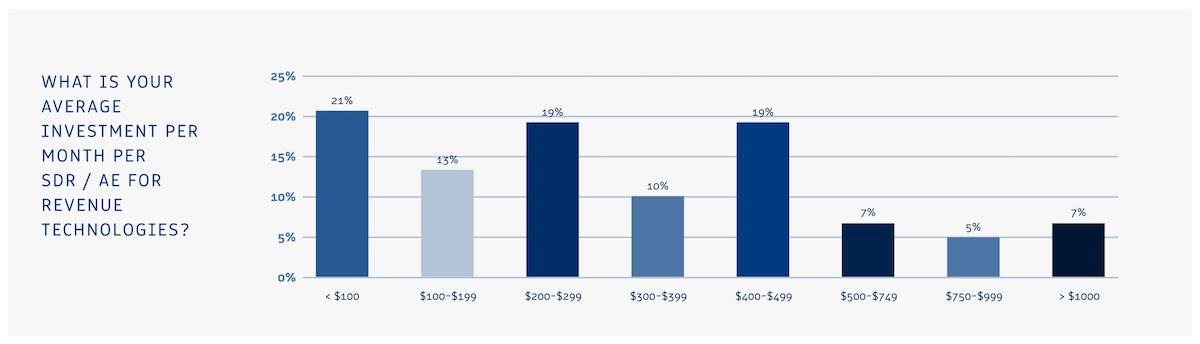

Data from a recent 2021 Revenue Operations and Customer Acquisition Benchmark Report produced by ringDNA and RevOps Squared revealed that 38% of the companies surveyed are spending $400 or more per rep (SDRs or AEs) per month:

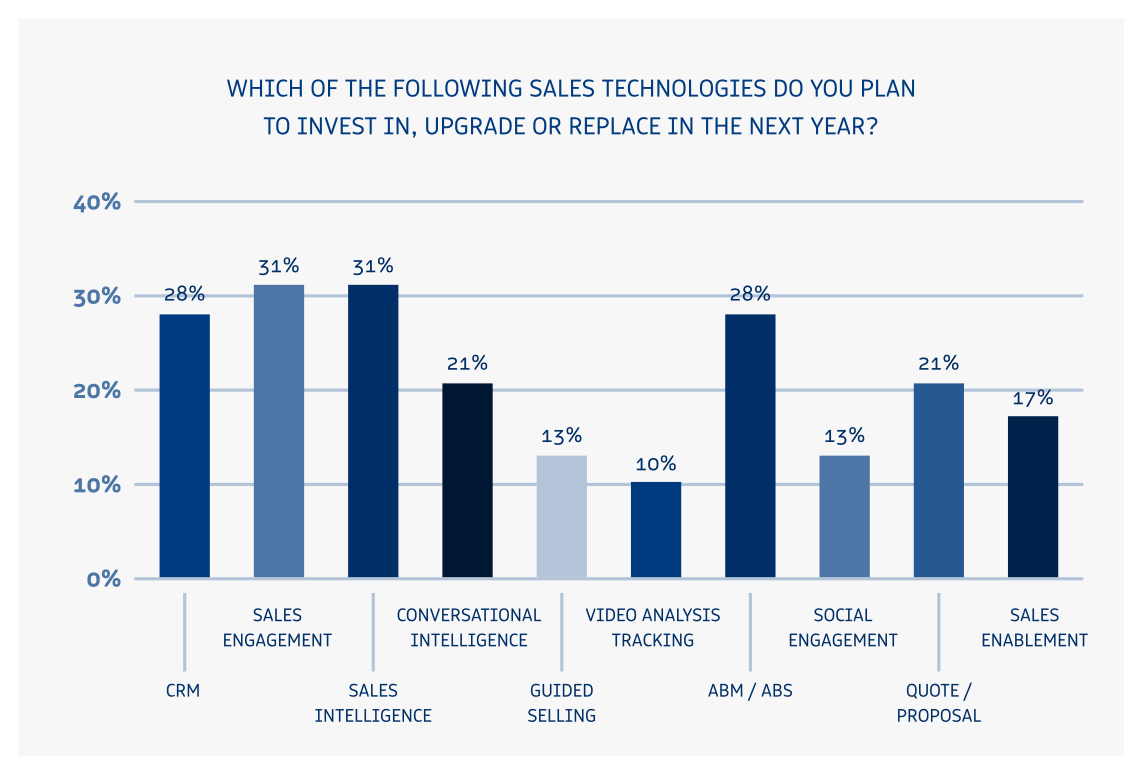

That’s a pretty significant investment. And indications are that investment is going to grow in 2021, as companies embrace a range of innovative salestech products:

Salestech had been on the rise for the past few years. But as with other digital capabilities, the disruptive circumstances of 2020 catalyzed an acceleration of adoption of these technologies for leveraging distributed sales teams, remote selling, and an expanding array of digital customer touchpoints.

Yet we’re still quite early in the penetration of the potential market. Many of the leading salestech companies only have install bases in the hundreds or single-digit thousands today. They’re poised for tremendous growth to tens of thousands and hundreds of thousands of customers in the years ahead.

Aragon Research predicts sales engagement will be a $5.59 billion market by 2023. Data Bridge Market Research estimates sales intelligence will be a $4.89 billion market by 2027. And 360 Research Reports projects sales enablement will be a $3.08 billion market by 2026.

Most of those estimates were calculated before the digital acceleration of 2020. I think we’ll see much larger numbers much sooner.

For martech, the advancement of salestech is a wonderful thing.

First and foremost, all of these digital sales touchpoints will contribute phenomenal data to a company’s overall revenue operations stack. It will provide much more granular detail on which tactics resonate best with which segments of customers, spanning the entire customer journey. In turn, this will make it easier to leverage that data in shaping personalized marketing and sales motions to those audiences. It will enable marketing teams to be much more targeted in their approach, much higher in the funnel.

In B2B, expect this to take account-based marketing/account-based sales to a whole new level.

The increasing digital savvy of sales teams — and the sales operations leaders supporting them — will also engender greater alignment and collaboration between marketing and sales as a whole. More blending of marketing and sales will happen inside martech and salestech tools, which will facilitate blending the plays and processes these teams run together.

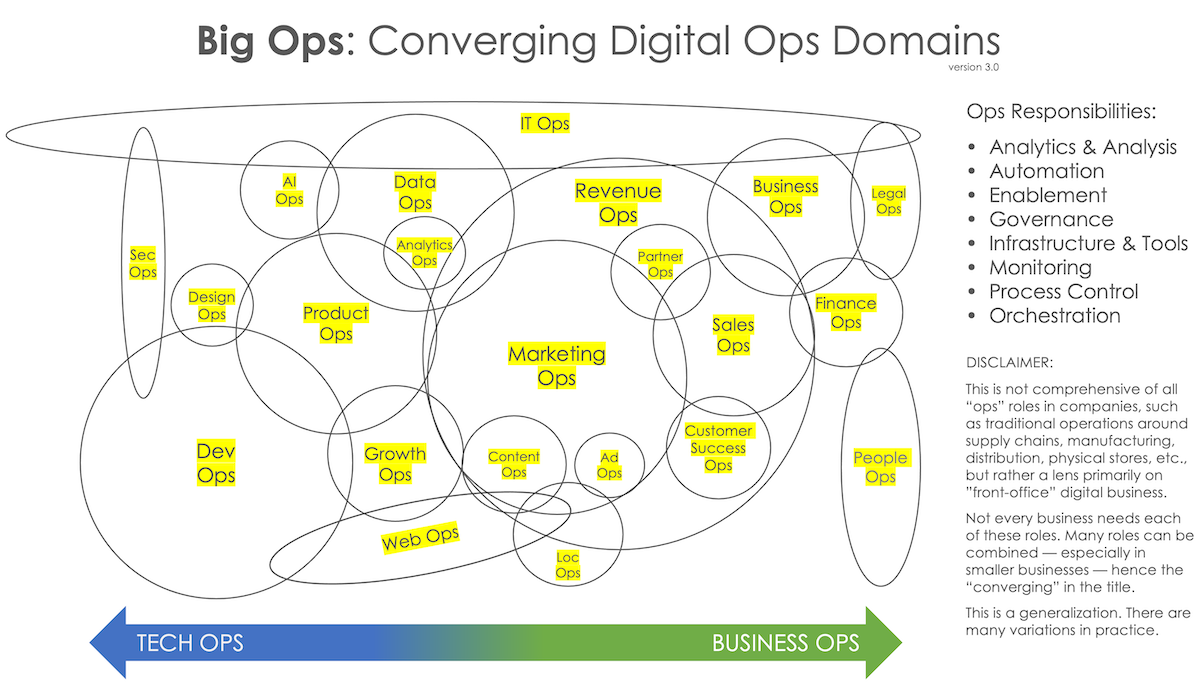

This collaborative intersection between marketing ops and sales ops is a driving force behind the rise of coordinated “revenue operations.” And that intersection is just one piece of the overall movement to Big Ops that I believe will be one of the five defining trends of martech for the decade ahead.