Have you ever wondered how challenging it would be to measure the return on your brand investment? For professional services firms, it may be easier than you think.

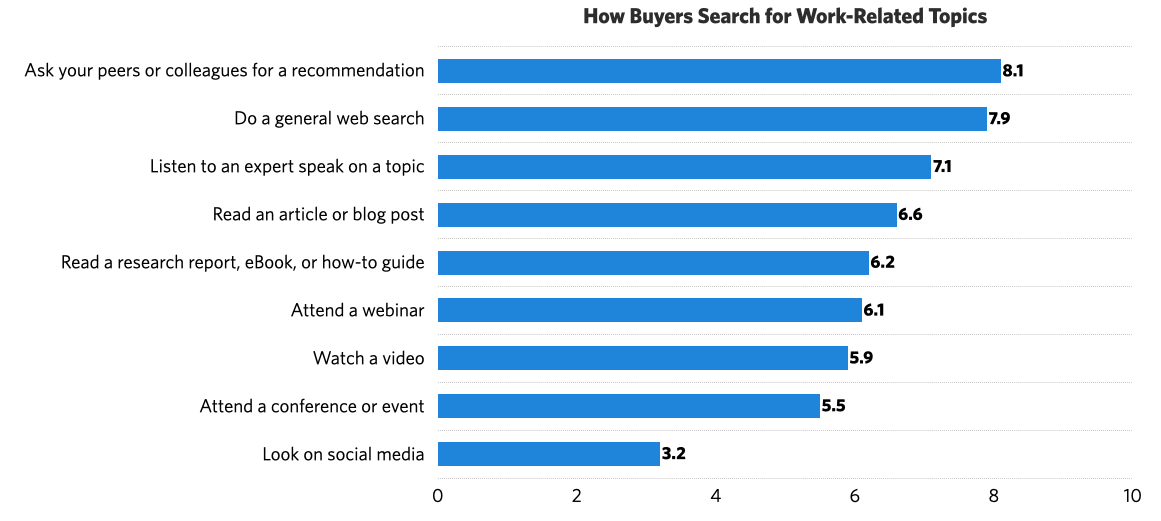

Like all good marketing initiatives, brand tracking should start with a fundamental understanding of your buyers. Our research shows that, while asking a friend or colleague for a recommendation remains—barely—the top way businesses search for a new professional services firm, this approach is being overtaken by digital methods such as web search, and reading online articles/blog posts.

As digital communications continue their steady rise in prominence, it’s imperative to understand how your target audience searches for insights and expertise to address their business problems.

Brand Tracking Tools

Once you understand your buyers’ search channels you can choose the appropriate tools to monitor your brand.

Today, tracking your professional services firm’s online brand is more important than ever. And while the latest marketing technology can often be overwhelming, marketing professionals may already have many of the tools they need to track their digital brand over time.

What is Brand Tracking?

Brand tracking is the process of measuring changes in brand perception over time. It quantifies a return on brand investment and supports brand strategy decisions.

With enough data and the right tools, you can measure this perception almost instantly. For example, consumer brands with large social followings can track their brands in real-time using social listening tools to measure what is being said about their brand, campaign, competitors, and product or service. Unfortunately, most professional services firms don’t have a large enough social following to make this kind of real-time brand tracking practical.

But that doesn’t mean professional services firms can’t utilize brand tracking.

Brand tracking in the B2B space boils down to two main approaches:

- Gathering/monitoring experiential feedback

- Surveying your buyers

Both approaches are critically important. Firms that deploy both of these techniques are far more likely to achieve superior results from their brand tracking efforts.

Gathering and Monitoring Experiential Feedback

Capturing the right information at the right time is essential to a successful inbound marketing strategy — and it’s equally important in brand tracking. In-the-moment experiential feedback allows you to take the pulse of your brand.

By understanding your buyers’ search channels (see chart above) your firm will know which channels you need to monitor for critical experiential feedback.

Brand Tracking Examples

For instance, many professional services firms leverage their website for lead generation. Potential buyers are willing to exchange an email address for premium content — a critical milestone on the buyer’s journey. Measuring content downloads is a good example of operational data that can be tracked over time. But how valuable was the content they downloaded? One way to find out is to send a simple automated follow-up email asking if they found the content useful. Combining these metrics will tell you the quantity of downloads and the quality of the content.

Other methods of collecting experiential feedback include embedding listening posts within your marketing content. For example, you might ask for feedback from your webinar attendees, or put a 1- to 2-question popup survey on your website. Simple techniques like these can help you understand how your buyers view your firm. You can also monitor comments and reactions to digital content, such as blog posts or LinkedIn posts, to gauge audience sentiment toward your brand.

These are just a couple examples of how experiential feedback can be collected at key listening posts along your buyer’s journey. While experiential feedback is a great way to monitor buyer engagement with your brand, it doesn’t always paint the full picture. To get a more holistic understanding of how buyers view your brand, you’ll need to conduct a brand tracking survey.

Surveying Your Buyers

Do you have a solid understanding of how your buyers view your brand today? If you do, then you probably already know what your key performance metrics are. If you don’t, consider conducting a brand survey to establish your firm’s baseline performance. Once your brand baseline is established, your firm will have a great starting point to track brand performance over time.

Only by understanding how buyers see you — your strengths and weaknesses — can you know where to focus your attention. This is where a brand survey of your audience comes in handy. The data you gather allows your firm to establish powerful baseline metrics such as:

- Visibility/Awareness – How visible is your firm in the marketplace?

- Consideration – Would your prospects consider using your services?

- Relevancy – How relevant are your services to clients?

- Value – How valuable are the services you provide?

- Delivery – How well do you do what you say you will do?

- Loyalty – How likely are your clients to work with you in the future?

- Referrals – Have your clients referred your firm?

- Reputation – How good is your reputation in the marketplace?

- Visibility – How visible is your firm in the marketplace?

Quantitative vs. Qualitative Tracking

To accurately track your brand performance using a brand survey, you will need to ask a mix of quantitative and qualitative questions. Quantitative questions, such as likelihood to refer (NPS) or level of client satisfaction, are asked on a numeric scale and can be averaged across participants. These types of questions are easy to track over time by comparing the delta in averages across multiple brand surveys.

Open-ended (qualitative) questions are also important to include in brand surveys, but they are often more difficult to track. One way to quantify open-ended questions is to categorize the responses into categories or common themes. You then can measure the percentage of participants who mention these common themes, and monitor the changes in those percentages over time.

Tracking Your Competitors

Brand surveys can also be used to keep an eye on the competition. Within the survey you can ask respondents to list all firms they identify as a competitor to your firm. This method demands unaided responses and will likely yield a small number of responses. These are the competitors that are top of mind to your respondents.

You can also use an aided competitor question in which you provide a list of competitors and ask the respondent to select the ones they are aware of. Aided questions are helpful since respondents who are unable to think of a competitor are likely to recognize one or more if the names are in front of them.

Like the baseline questions about your firm, both aided and unaided brand survey questions can be tracked over time.

Brand Survey Methods

In B2B brand tracking, there are two main methods of administering a brand survey. The first method is to survey a group of your clients and/or prospects. Typically this is done by emailing a survey link or calling respondents to ask for participation. Using an impartial third party research firm (such as Hinge) for these types of brand studies usually delivers greater survey participation and more insightful, unbiased results. If participation is low, a firm can work with a sample provider to screen and purchase prospects.

The second common brand survey method is to conduct a post-project survey at the conclusion of an engagement. Post-project surveys are important for understanding your brand perception, and they can also be used to measure firm performance.

Brand Survey Length and Cadence

Brand surveys, whether standard or post-project, should typically be no more than 10-15 questions in length and last about 5-10 minutes. It’s important to keep these surveys short because respondents are often busy and can become irritated—and less likely to participate in the future—if the survey drones on for too long.

Standard brand surveys should be administered roughly once a year. In the B2B space, a firm’s client base or prospect list may not be large enough to handle monthly or even biyearly surveys. It’s also important to avoid overburdening your prospects and clients with surveys, as it might negatively affect your brand perception. Lastly, brand tracking surveys can be both timely and expensive. From a financial standpoint alone, it might not be practical to conduct a brand survey multiple times a year.

How to Use Your Brand Tracking Results

Have you maintained your strengths? Are you addressing your challenges? What changes should you make to your brand strategy? By measuring key performance metrics, brand tracking tools can inform the answers to tough questions like these before it’s too late.

To compete in today’s fast-changing marketplace, you need to continually take the pulse of your target audience. Only knowledge will equip you with the information you need to stay relevant in their minds. Brand tracking gives you essential tools to collect and make sense of these changes. It also offers a powerful way to quantify the return on your firm’s marketing investment.

How Hinge Can Help

Nothing uncovers what motivates your audiences like brand research—and research is an integral part of Hinge’s powerful approach to marketing. Learn more about our research services or contact us to learn whether research makes sense for your professional services firm.

Additional Resources

- Our Professional Services Guide to Research gives you the tools and knowledge you need to lead your firm through conducting research.

- Understand your buyers. Win more business. Read the latest findings from, Inside the Buyer’s Brain – Fourth Edition, the biggest study of professional services buyers to date. It’s free!